Comparing Forwardly vs QuickBooks Bill Pay? While both aim to simplify payments, they take very different approaches in pricing, speed, and flexibility. Let’s understand the difference so you can decide which one truly fits your business needs.

Forwardly overview

Forwardly is a modern B2B payments solution designed for speed and flexibility. Businesses can move money in under a minute, and pay vendor bills instantly. It makes managing approvals easy with customizable workflows, lets you schedule payments around due dates, and keeps books accurate with automatic 4-way sync to QuickBooks and Xero, and other leading systems. Standard bank transfers are free, and the entire experience is built to help growing companies move money faster, smarter, and with less effort.

QuickBooks Bill Pay overview

QuickBooks Bill Pay is part of the QuickBooks Online platform, designed to help small businesses pay bills directly from their accounting software. You can schedule payments, send ACH transfers, or mail paper checks to vendors. The service offers different plans with varying features, such as approval workflows and payment tracking. While it’s convenient for QuickBooks users, instant payment options are limited and may come with extra fees or restrictions.

AI bill automation

Both Forwardly and QuickBooks Bill Pay aim to take the manual work out of paying bills, but Forwardly’s AI features allow you to upload or email bills straight into your account. From there, it automatically pulls out key details, matches the bill to the correct vendor, and even schedules the payment so you don’t have to touch it again.

QuickBooks Bill Pay also offers automation by letting you forward invoices via email or bulk upload, creating draft bills ready for your review. While both save time, Forwardly goes a step further by handling vendor matching and scheduling in one seamless step, reducing the number of clicks between receiving an invoice and marking it paid.

Number of users

Team access is another area where the differences stand out. Forwardly lets you add as many users as you need without extra charges or limitations, which is ideal for growing teams or accounting firms managing multiple clients.

In QuickBooks Bill Pay, user access depends on your QuickBooks Online subscription. Some lower-tier plans restrict the number of collaborators, meaning you might have to pay more just to get your whole team on board. Forwardly’s unlimited-user approach removes that worry entirely.

Subscription fees

Forwardly’s pricing philosophy is simple: no subscription fees for its core features. You can use advanced functions like approval workflows, all with no monthly subscription charges.

QuickBooks Bill Pay, while included in QuickBooks Online, locks some of its more advanced features like expanded ACH payments or approval workflows, behind its Premium and Elite tiers, which come with additional monthly costs.

For businesses trying to control overheads, Forwardly offers a way to access full functionality without committing to a higher-priced plan.

Instant payments

If speed is your priority, Forwardly is built for it. Using both the RTP Network and FedNow Service , it processes payments in under 60 seconds, day or night, even on weekends and holidays. This means vendors get their money right away, and you never have to worry about bank cut-off times.

QuickBooks Bill Pay, on the other hand, moves at a more traditional pace. Standard ACH transfers take three to five business days, and mailed checks can take up to ten.

While QuickBooks does offer faster ACH options, these often come with added fees and eligibility requirements, making them less straightforward than Forwardly’s always-on instant transfers.

Bill payment speed flexibility

Payment speed flexibility gives you control when paying bills. With Forwardly, you choose how fast your vendors get paid, instant transfers land in their account in 60 seconds, or you can opt for same-day, next-day, or standard transfers, depending on your cash flow needs. In contrast, QuickBooks Bill Pay mostly processes standard ACH or checks in 3–5 business days, and while Faster ACH is available, it comes with extra fees, must be scheduled early in the day, and isn’t available on all plans. This means Forwardly not only pays faster but gives you the flexibility to time payments in a way that suits your business.

Auto payments

Both platforms understand the importance of never missing a due date, but Forwardly makes automation a standard feature for everyone. You can schedule bills so they’re paid exactly on time, helping you avoid late fees and maintain good vendor relationships.

QuickBooks Bill Pay supports scheduled and recurring payments too, but the depth of automation depends on the plan you’re on, some advanced scheduling tools are only available in higher tiers. Forwardly’s approach ensures every user has access to time-saving automation from day one.

Payment approval workflows

Managing who can approve payments and under what conditions is key for businesses that handle multiple expenses and users. Forwardly offers customizable approval workflows to all its users. You can set rules based on payment amount, assign specific roles, and keep track of every action in a detailed audit trail.

QuickBooks Bill Pay offers similar workflow capabilities, but only for Elite plan subscribers. This means smaller businesses on lower-tier plans might miss out on valuable control features unless they upgrade. With Forwardly, these controls are part of the package, no matter the size of your business.

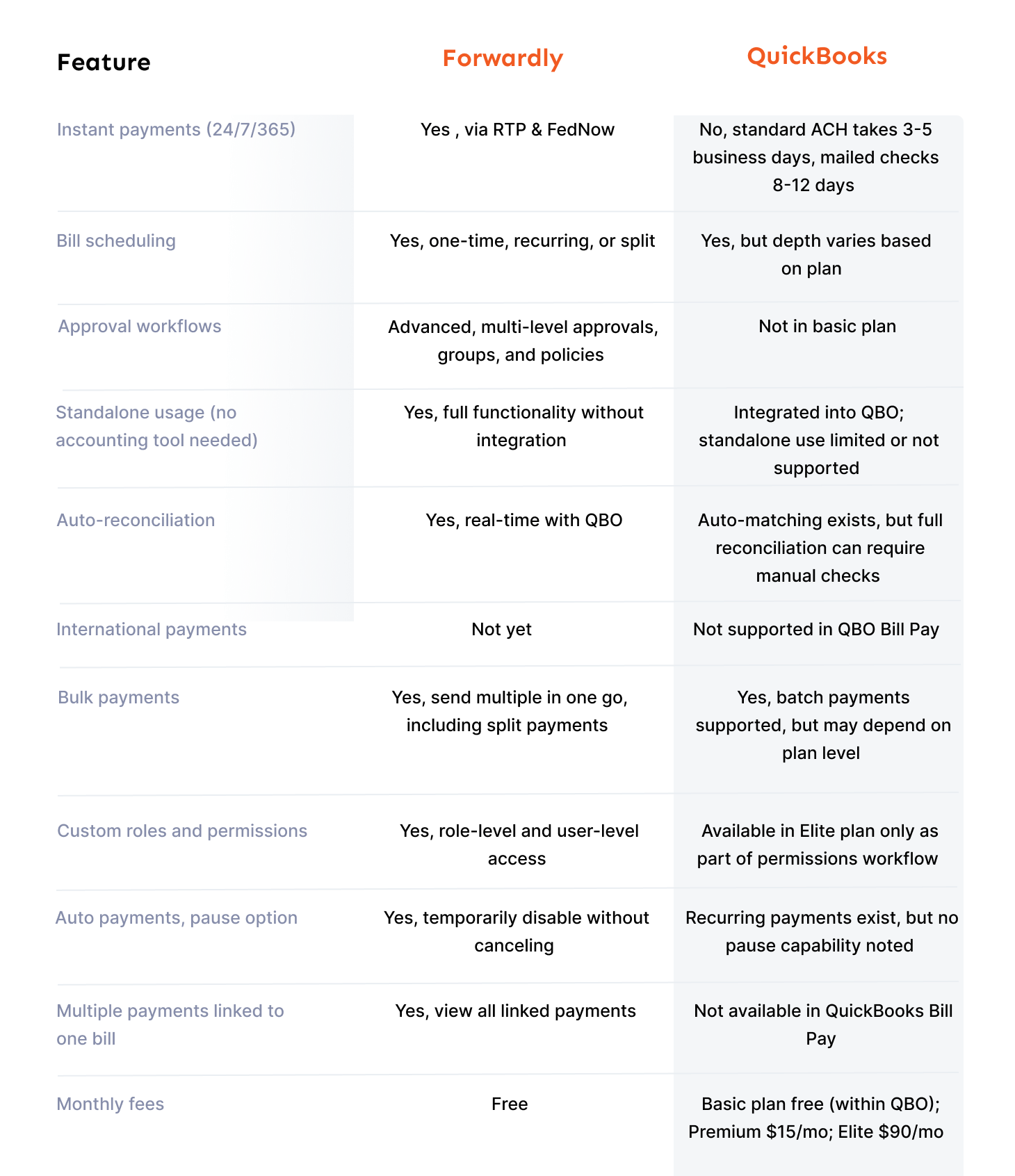

Feature-by-feature comparison: Forwardly vs QuickBooks Bill Pay

Why you should choose Forwardly?

When deciding between Forwardly and QuickBooks Bill Pay, the real question is what kind of payment experience your business values most, and how much you’re willing to pay for it.

Predictable costs that scale with you

Forwardly’s flat, transparent pricing model means your costs won’t rise high as your transaction volume or team size grows. In QuickBooks Bill Pay, the more you use it, or the more people you add, the more likely you’ll hit plan limits and be forced into expensive upgrades. For a scaling business, Forwardly protects your margins while growing with you.

Operational flexibility without vendor lock-in

Forwardly integrates with multiple accounting systems, so your payment processes aren’t tied to a single platform. QuickBooks Bill Pay locks you into QuickBooks Online, which can limit your options if your accounting needs evolve, you expand internationally, or you work with clients on different systems. Forwardly lets your payments strategy adapt as your tech stack changes.

Faster cash flow

Forwardly’s 24/7 instant payments mean your vendors and contractors get paid in seconds, keeping your supply chain smooth and your relationships strong. Delays in QuickBooks Bill Pay’s ACH cycles can strain relationships, slow projects, and create cash flow uncertainty, especially in industries where timing is everything.

Full capabilities from day one

With Forwardly, every account, no matter how small, gets the same access to advanced controls, approval workflows, and automation. QuickBooks Bill Pay holds these capabilities back for higher-tier subscribers. That means Forwardly enables enterprise-grade governance and compliance from your very first payment, which is essential for scaling without adding headcount.

Lower administrative overhead

Forwardly’s automation, real-time reconciliation, and bulk payment handling reduce the number of manual touches in your AP process. In QuickBooks Bill Pay, feature gating and slower settlement times mean more time spent chasing approvals, confirming payments, or manually reconciling accounts. Less admin time means more hours focused on revenue-generating work.

Built for-growth without feature walls

Forwardly supports unlimited users, multiple client accounts, and high transaction volumes without charging more. QuickBooks Bill Pay limits access based on your subscription level, making it harder for growing teams, accounting firms, or multi-entity businesses to operate without constant plan changes.

Reduced risk through real-time data

Forwardly provides live bank balance checks before payments, helping prevent overdrafts and cash flow missteps. QuickBooks Bill Pay relies on your accounting file data, which can lag behind real-world balances. For a scaling business, that real-time accuracy reduces financial risk.

Take control of your business payments today

Ready to see how much faster and simpler bill payments can be? Experience Forwardly’s instant payments, built-in approval workflows, and zero monthly fees for yourself.

Book a 1:1 demo today and start managing your payables the smarter way.

Back to Blog

Back to Blog