As a small business owner, managing business payments can be complex and time-consuming. With numerous reliable, efficient and faster payment options available in the market, how do you figure out the best option for your business? In this blog, we will explore the top six B2B payments companies to help streamline your operations and process transactions faster, including Forwardly, Melio Payments, Bill.com, Plooto, Veem and GoCardless.

By exploring these top B2B payments companies, you can identify the solution that best aligns with your business needs and goals. Whether you prioritize instant payments, cash flow management, international payments, or recurring billing, there’s a payment solution out there to help optimize your financial processes and drive business success.

BILL

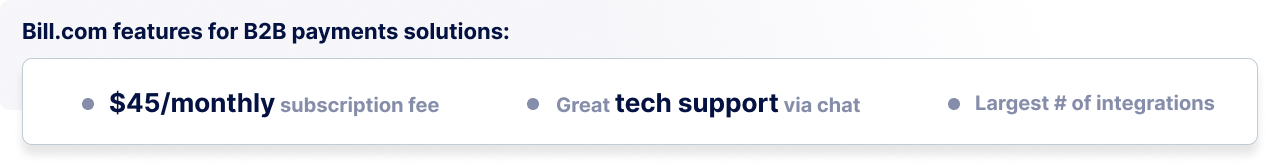

BILL is among the most well-regarded of all B2B payment companies, offering automated accounts payable, accounts receivable solutions and financial automation software tailored to small and midsize businesses (SMBs). The platform helps businesses streamline payment processes, including invoice scanning, approval workflows, and electronic payments. BILL is an excellent choice for businesses looking to automate their payment processes and reduce administrative workload.

Pros

- Automated bill payment and invoicing

- Integration with popular accounting software such as QuickBooks Online, Sage Intacct, Oracle NetSuite, Microsoft Dynamics, and Xero

- Ability to assign approval workflow and customizable permissions

- Multiple payment options, including ACH, credit cards, checks, and instant transfers

- Great platform for remote working environment for users with an easy mobile app

- Their support team can reissue a check if necessary

- Great for accounts payable as vendor can directly submit their direct deposit info

Cons

- Slow payment processing causes workflow delays; can hold payments up to a few days to a week

- Instant transfers can take up to 30 minutes

- Costly subscription fees for additional features start at $45/month per user

- Some users have reported difficulty with customer support and occasional bugs and technical glitches like integration with accounting software

- Difficult to get support as tech support is only available by chat

- A learning curve for first-time users and those unfamiliar with the software

- Complicated onboarding process with syncing historical client data potentially causing errors

- Limited customization options for branding and appearance

- Limited detailing for In-depth payment descriptions or grouping

Forwardly

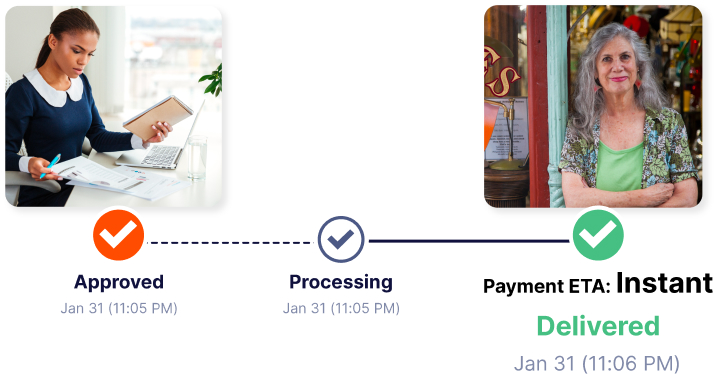

Forwardly offers a cash flow management tool with an end-to-end payment solution offering seamless and secure payment transactions within the app. The platform provides several tools to help manage cash flow with faster payment options like instant payment transfers and same-day ACH transfers. Forwardly is the best payment processor for small businesses that need to manage their accounts payable and accounts receivable efficiently. Forwardly supports The Clearing House’s RTP network and FedNow Service from the Federal Reserve.

Recognized as the “Accounting Tech of the Year” at the US Fintech Awards, the winner of “Best Real-Time Payments Solution” at the 2023 PayTech Awards and 2024 CPA Practice Advisor Technology Innovation Award, Forwardly stands out as one of the top B2B payment companies for faster payments.

Pros

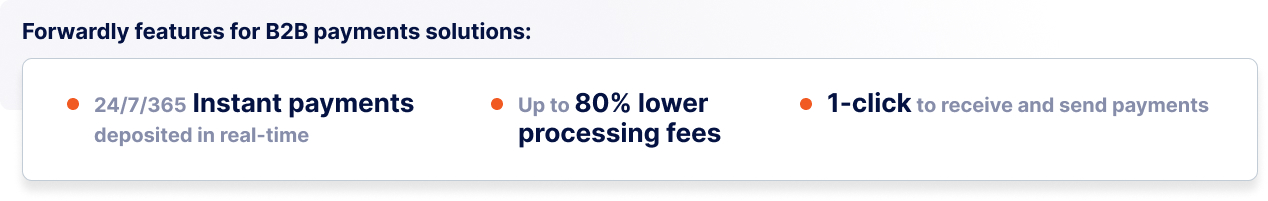

- Payments are received in 60 seconds, 24/7/365; Forwardly stands out as a leading B2B payment company for being the most cost effective option.

- Saves time by using a one-click invoice approval for sending or receiving payments

- Integrations with leading accounting software, such as QuickBooks Online, Xero, FreshBooks and Zoho Books, with the immediate roadmap including many more leading accounting and ERP systems

- The Forwardly Business Network (FBN) is a feature that simplifies business payment workflows. It allows businesses to sync invoices and bills from their accounting systems, request and receive payments from customers, and pay vendors—all seamlessly connected through the network.

- No monthly cost; free for all users as it’s 100% free to make an account

- Up to 60-80% lower processing fees than legacy payment options: Cost of receiving instant payments is 1% (minimum $1, maximum $10 per transaction)

- Offers features like automatic payments, schedule payment and partial payments

- Seamless and instant transactions facilitated by Forwardly’s bank-agnostic transfer capabilities, ensuring instant settlements

- Same-day ACH transfers are free if the bank doesn’t support instant payment technology

- Offers pay by credit card options as well.

- Bill payments are absolutely free

- Instant updates on your bank balance before making payments, providing full visibility into your financial status

- Cash flow forecasting to predict upcoming payments and business cash flow

- Robust partner program with referral revenue opportunities

Cons

- US Only: Forwardly only supports domestic US bank-to-bank instant payments

- Forwardly does not support international currencies but offers a cashflow tool for users worldwide

- Daily limit of $10,000 for real-time payment to vendors unless approved for higher limits

Melio Payments

Melio is a small business-focused account payable and receivable tool. It offers a simple and easy-to-use platform that allows businesses to pay their bills and invoices using a bank transfer, debit card or credit card. The platform offers several features, including recurring payments, payment tracking, international payments and easy integration with QuickBooks Online. Melio Payments is perfect for small businesses that need a simple and intuitive platform for managing payments.

Pros

- Easy to send payments made through ACH, instant payments, credit cards, and checks

- Schedule future and automate recurring payments

- Simple and user-friendly interface for users

- Sync with accounting software, such as QuickBooks Online and Xero

- Offers payment by check, with Melio handling the printing and mailing process

- Offers basic bill approval workflow

- Makes it easy to track the status of payments for simple AP management

- Split bills for multiple payments and payment methods

Cons

- High fees for credit card payments, expensive for businesses to accept credit card payments from their customers

- Recently launched, instant payments cost 1.5% fee (maximum $50 per transaction), billed separately. If you opt for card payments with Melio, a 1.5% instant transfer fee is added on top of the 2.9% card processing fee. Which can be too high for the small businesses.

- High processing fee for faster payment option: Fast checks ($20) and up to $30 for fast ACH bank transfer

- Slow transaction speeds; typically take three business days to process payments and longer for checks to be updated in the system

- Instant payments take minutes whereas other platforms offer instant payments in just seconds.

- Complicated late fees and can withhold payments to vendors if issues arise

- Complex and multiple payment approval processes for payments and vendors

- Users find it difficult to get a response from the customer support leading to unresolved resolutions

Veem

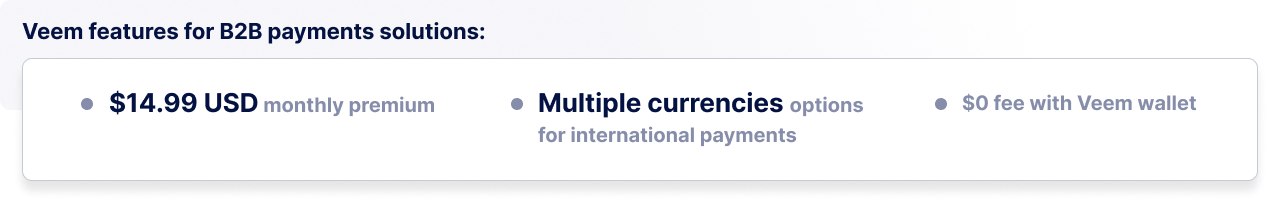

Veem offers a global payment platform that simplifies how you can send and receive payments domestically and internationally. The platform offers competitive exchange rates and allows businesses to pay vendors and suppliers in over 100 countries. Veem is an excellent choice for businesses that conduct international transactions regularly.

Pros

- Fast and efficient; Veem’s payment platform allows businesses to send and receive payments quickly and easily

- International exchange; exchange rates within the app for international payments

- Multiple currencies; supports payments in various currencies, making it easy for businesses to make payments to international vendors and suppliers

- Offers a free basic plan or a premium plan for USD 14.99 monthly

- Provides real-time tracking and notifications of payment status

- Fast ACH transfer (1 business day) 0.5% of the total payment amount

- Can be integrated with accounting software, including QuickBooks Online, Xero, and Oracle Netsuite

Cons

- Compared to other payment platforms, Veem’s feature set may be limited, especially for businesses with more complex payment needs

- Only offers basic reports templates for billing and invoicing

- High fees for international payments: 3.5% for International Wire (Local currency)

- Exchange rates may not be favorable for all currencies

- Veem’s customer support can be slow to respond at times, which can be frustrating for businesses with urgent payment needs

- Veem’s verification process can be lengthy and may require significant documentation, which can be a barrier for some businesses

- Limited list of local banks to be set as beneficiary account requires manual creation in the app

- Long international transfers can wait up to 5 business days for settlement, compared to other options that offer within a day or two

GoCardless

GoCardless is a payment processing platform that allows businesses to collect recurring payments from customers worldwide. It enables automated bank-to-bank (ACH) transfers, eliminating the need for businesses to chase payments and reducing late payments. With GoCardless, businesses can set up payment plans, manage subscriptions, and offer customers flexible payment options. While the platform offers ease of use and reliable processing, there may be limitations for businesses operating in certain industries or countries, and there are transaction fees.

Pros

- Easy to set up and use, with a simple and user-friendly interface

- No monthly fee for users with core features available for collecting ad-hoc services and recurring payments

- Low transaction fees for smaller transactions (best for transactions below $3,000- capped at $4)

- Offers Direct Debit and online bank transfers

- Provides automated payment tracking and reconciliation

- Offers domestic exchange rate within the app for accounts receivable

- Integrates with a variety of software platforms, including Xero, QuickBooks, and Salesforce

- Offers subscription payments for recurring payments

Cons

- No support for credit card payments

- Limited payment options compared to some competitors

- Some users have reported difficulty with customer support and dispute resolution

- Limited customization options for payment pages and emails for the basic platform tier

- Costly monthly fee for premium access starts at $75 and can go to $350+ a month

- Complicated pricing structures; transactions of +$3,000 charge an additional 0.3% fee on top of the base transaction fee (1% + $0.40) to the portion of the transaction above the $3,000 threshold

- Complicated pricing structures for international payments that may not provide a clear payout estimate for users

- The onboarding direct debit process can be challenging, and disputing cancellations or issues is tricky

Plooto

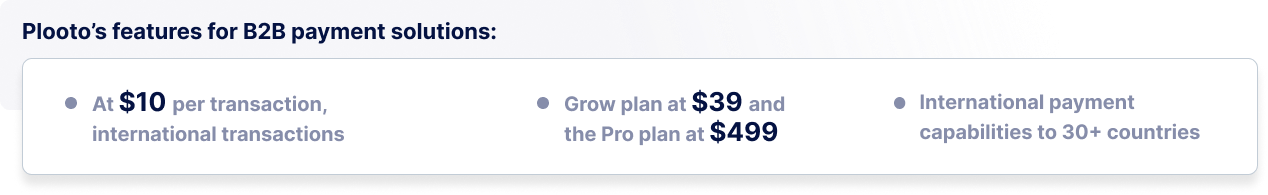

Plooto is a comprehensive platform designed to streamline businesses’ accounts payable and accounts receivable processes both domestically and internationally. With its all-in-one solution, Plooto allows for seamless automation of payments, unified processes, enhanced control, and simplified reporting. The platform offers a range of features including accounting integrations, customizable approval workflows, and recurring payments, and pre-authorized debit agreements. Also, Plooto facilitates automated workflows and provides the convenience of Plooto Instant, requiring a pre-funded wallet for instant transactions.

Pros

- International payment capabilities spanning over 30 countries

- Support for various payment methods such as ACH/EFT, credit cards, instant payments and online check payments

- Centralized storage for invoices and payment details.

- The efficient approval process improves security, reduces travel

- Offers one-month free trial

- Plooto Instant is available on the subscription plans

Cons

- Plooto Instant, while convenient, has the drawback of requiring pre-funding the wallet, resulting in longer processing times of 1-2 business days. Accessing deposited funds may incur an additional delay of 3-5 business days.

- Pricing might pose a challenge as it offers two plan options: the Grow plan at $39 and the Pro plan at $499, and $0.5 for each domestic payment which could be considered costly for some businesses.

- Users may find it challenging to adjust to Plooto’s operational style, longing for a more straightforward process akin to E-transfer.

- At $10 per transaction, international transactions with Plooto are especially expensive.

Choosing the right payment solution can significantly impact your business operations. Notably, B2B payment companies like Forwardly, Melio Payments, BILL, Veem, GoCardless and Plooto are all excellent payment solutions that can help you streamline your payment processes and increase efficiency. Evaluate your business needs and choose the solution that best fits your requirements.

Sign up for Forwardly today to simplify your B2B payments.

Back to Blog

Back to Blog