Running a business is tough, and success often hinges on the most important responsibility, which is managing accounts receivable (AR) and accounts payable (AP) effectively. Even if your products or services are excellent, problems can quickly arise if these processes aren’t streamlined. But don’t let that overwhelm you.

This blog compares two modern payment solutions, Forwardly and Melio Payments, both designed for handling AR and AP. The objective is to help small and medium-sized businesses (SMBs) in choosing a service that suits their needs seamlessly, offering a balance of features, easy to use, cost-effectiveness and perhaps, a touch of innovation.

The goal isn’t just to solve your problems; it’s to improve the entire financial workflow, ensuring smoother sailing in the choppy seas of your business operations.

Forwardly vs. Melio Payments: What’s the difference?

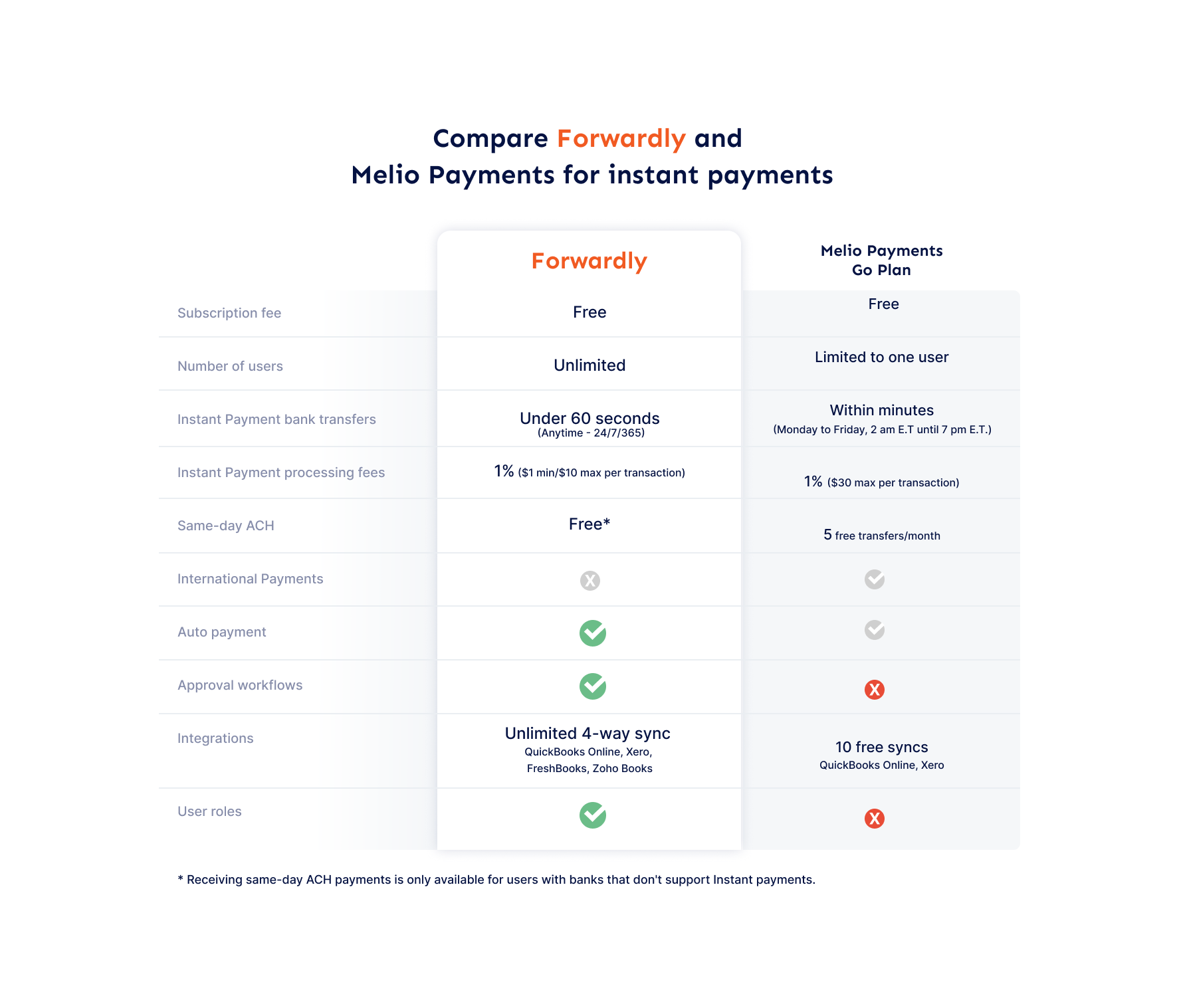

When it comes to pricing, Forwardly makes it easy by offering all its features for free—no subscription fees, period. On the other hand, Melio gives you a few features for free, but to unlock most of the good stuff, you’ll need to sign up for one of their paid plans: Core at $21.25/month or Boost at $46.75/month, with an extra $10/month for each additional user.

Forwardly integrates with QuickBooks Online, Xero, FreshBooks and Zoho Books whereas Melio integrates with only QuickBooks Online and Xero. Forwardly also stands out with 4-way sync compatibility for QuickBooks Online and Xero. This means your payments, invoices, and records are always in sync, which saves you time and keeps errors at bay. Melio offers 10 free syncs with QuickBooks Online and Xero on its free plan. If you upgrade to Core or Boost, you’ll get unlimited 2-way auto-sync with QuickBooks, and Boost even adds support for QuickBooks Desktop.

As for payment options, Forwardly keeps things super simple with instant payments, same-day ACH, and credit card payments—and best of all, you don’t need a special wallet or bank account to use it. It’s as straightforward as it gets!

Melio gives you a bit more flexibility. You can pay by card, ACH, or even send checks and even international payments, but it’s important to note that some payment methods may come with extra fees or slower processing times.

To make it easier to understand, let’s break down the differences in a side-by-side comparison chart.

What makes Forwardly stand out?

Instant payments

Until December 2023, Forwardly stood alone as the exclusive real-time payment solution for small businesses in the United States, providing instant payments. Recognizing the challenges of delayed payments, Forwardly took the lead by offering instant payments from the outset, initially leveraging the RTP network. After the FedNow Service launched in July 2023, Forwardly joined both the RTP Service and FedNow Network for even faster payment transfers. Meanwhile, Melio has recently introduced instant payments through debit cards or bank transfers (ACH).

Always available, no strings attached

Forwardly’s instant payments work 24/7, all year round, even on holidays. But Melio’s instant payments are only available from Monday to Friday, between 2 am and 7 pm E.T. With Forwardly, there are no tricky conditions – you can get paid whenever and wherever. That’s a big advantage over Melio!

Speed

Forwardly stands out by delivering instant payments in under 60 seconds, while Melio takes around 30 minutes. Melio offers different payment methods, but each comes with its own waiting game. ACH transfers can take up to three business days or more, and regular paper checks can take five to seven business days. Even if you speed things up with Melio, you’ll still be waiting until the next day for payments made after 2 p.m. (ET).

Waiting for payments can harm a business’s financial health. Delayed payments have a damaging effect on businesses, with over a quarter of them admitting to struggling with accounts receivables tasks monthly. Forwardly excels in speed, enabling you to receive instant payments in just seconds, far outpacing Melio’s processing times. With Forwardly, you can enjoy the ease and efficiency of rapid transactions.

Affordability

Accounts payable

With Forwardly, sending payments is completely free. Whether you’re using instant payments that process in just 60 seconds or same-day ACH transfers, there are no fees involved, making bill payments fast and cost-effective.

For Melio, when paying bills using a bank account, there are a few options to consider. ACH bank transfers cost $0.50, and paper checks are $1.50. Need faster delivery? You can send a fast check for $20. For immediate payments, instant bank transfers come with a 1% fee, capped at $30, while same-day ACH transfers are also charged at 1%, with a cap of $30.

If you’re paying with a credit or debit card, the standard fee is 2.9% of the transaction. This applies to ACH transfers and checks, with fast checks costing an additional $20. For instant bank transfers, there’s an extra 1% fee (capped at $30). If you have a high credit line, you may be eligible for special rates, which could reduce these fees.

Accounts receivable

Forwardly stands out for its affordability, offering instant payments at just 1% of the transaction amount (with a minimum fee of $1 and a maximum of $10). It also goes the extra mile by providing free same-day ACH transfers for users whose banks don’t support instant payments.

When getting paid by credit card, fees are either free or 2.99%, depending on the transaction. Credit card fees can be applied to either the payer or payee, based on the payee’s business policy, giving flexibility depending on how you want to handle payment costs.

When receiving payments with Melio, there are a few free options to consider. Instant payments to a debit card or bank account come with a 1% fee. Similarly, same-day ACH transfers also incur a 1% fee. If you’re using a single-use virtual card, there’s no fee from the payment processor—it’s $0 to receive the payment, and you only pay your regular POS processing fees.

For small businesses, every penny matters. With Forwardly, you could save up to 80% on processing fees, which might translate to up to $24,000 in savings. That’s a significant amount you can use for your business’s essential needs and growth. Forwardly ensures your money is spent wisely.

Excellent support

Forwardly’s support is ready to help, ensuring that your concerns are addressed promptly.

You can raise tickets at the Forwardly support center if any aspect of the solution poses a challenge.

On the other hand, Melio Payments provides priority support for Core users and premium support for Boost users. However, many customers have expressed dissatisfaction with the overall support experience, citing unresolved issues. As a result, Melio’s support is often seen as less dependable compared to Forwardly’s proactive approach.

Better visibility

With Forwardly, you can set your limits, ensuring better control over your money and smarter cash flow management. You’ll get instant notifications for payments, so you always know when they are sent, awaiting approval, or received.

You can also have a clear view of your bank balance before making a bill payment at all times, ensuring you are in the know about your financial situation. And the best part? Forwardly facilitates swift, bank-agnostic transfers for immediate settlements and seamless reconciliation within seconds.

Multiple businesses

Forwardly streamlines business management by offering a single, user-friendly dashboard where you can effortlessly oversee multiple businesses. You have complete control over permissions, deciding who can access specific features. Plus, there’s no limit to the number of team members you can add, promoting a collaborative work environment. With Forwardly, managing and growing your businesses is simple and efficient.

On the other hand, Melio offers user roles and permissions—such as Owner, Admin, Contributor, and Accountant—but these are only available to Core and Boost users. For Boost users, advanced, custom multi-user workflows are included, giving you more flexibility in managing teams and roles, but it comes with a higher cost.

Start thinking Forwardly

Handling AP and AR can be a challenging task, but Forwardly, being one of the best Melio Alternatives is here to simplify the process for you. We understand that transitioning to a new payment solution might seem like a big change, but the benefits are significant – not only in terms of saving money and time but also in ensuring a stress-free business environment.

Our primary focus is to make your business operations more manageable and to streamline the payment process, making it easier for you to get paid promptly. Getting started with Forwardly is designed to be easy and user-friendly, providing you with the tools and support needed for a seamless transition. Let’s take a step forward together with Forwardly, where efficiency and ease meet in your business journey.

Back to Blog

Back to Blog