If you run a small business, it’s no surprise that you’ve probably been worried about your credit score. That little three-digit number can decide whether you get a business loan or not.

Now here’s the twist: Ever heard of a FICO Score? A lot of people think a credit score vs FICO score doesn’t make any difference, but it’s not true. And knowing the difference can seriously boost your chances of getting approved for business financing.

Some lenders use your FICO Score. Others use different models like VantageScore. Either way, they’re all checking to see if you’re a safe bet.

Let’s understand the basics so you get that loan.

What is a credit score?

A credit score isn’t just one arbitrary number, it’s a type of score used to show how good (or risky) you are with borrowing money.

When lenders say “credit score,” they usually mean a number between 300 and 850 that’s calculated based on your financial habits. Most scores are made by FICO or VantageScore.

Here’s how the numbers usually look:

- 800+ = Excellent

- 740 to 799 = Very Good

- 670 to 739 = Good

- 580 to 669 = Fair

- Below 580 = Needs Work

The score is based on:

- Payment history (did you pay on time?)

- Amounts owed (how much credit you’re using)

- Credit history length

- New credit activity

- Credit mix (cards, loans, etc.)

Also, there’s more than one type:

- FICO Score – most common with lenders

- VantageScore – used by apps like Credit Karma

- Industry scores – for cars, credit cards, etc.

Always ask which score someone’s referring to. Not all credit scores are created equal.

What is a FICO score?

The FICO Score is the credit score most lenders actually care about. It’s made by Fair Isaac Corporation and is used in 90% of lending decisions in the U.S., from credit cards to business loans.

How FICO scores are calculated

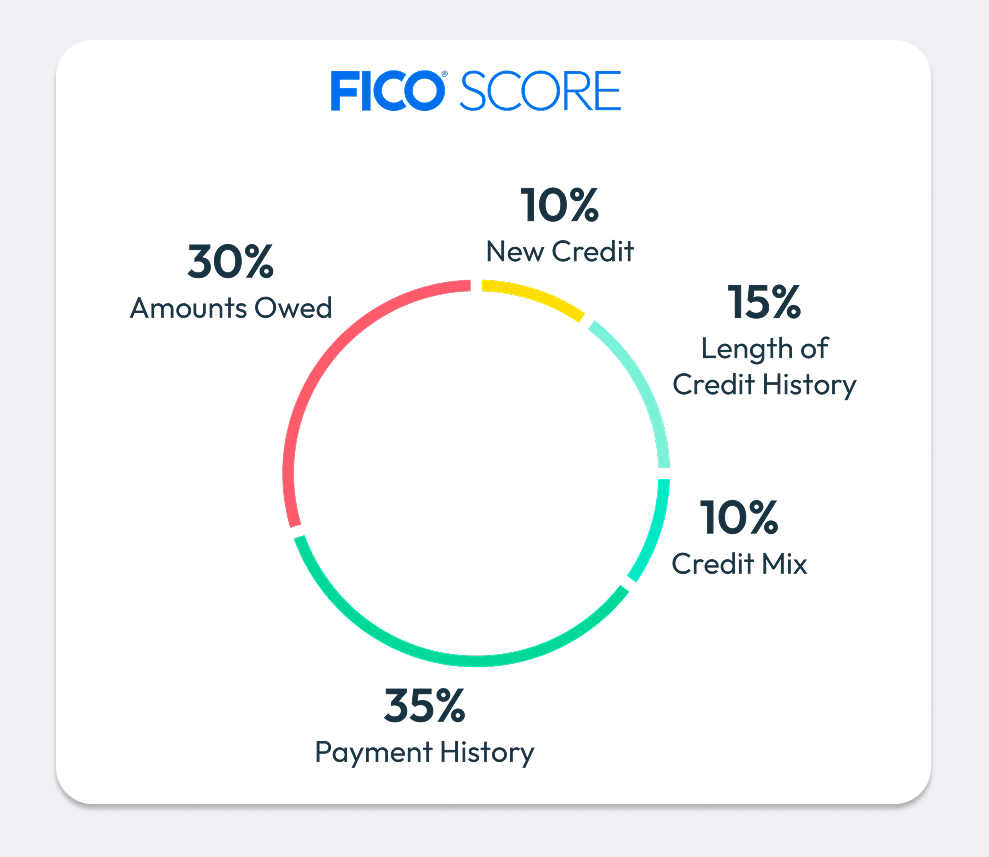

How it’s calculated:

FICO uses five key factors to score you (out of 850) and below are the weightages:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- New credit activity:10%

- Credit mix: 10%

Pay late or max out your cards? Your score drops. Pay on time and use credit wisely? You’re in good shape.

And yes, there are different FICO scores:

- FICO Score 8: Most common

- FICO Score 9 & 10: Newer versions with updates like medical debt handling

- Industry versions like:

- FICO Auto Score (for car loans)

- FICO Bankcard Score (for credit cards)

- FICO SBSS (for small business loans)

So no, FICO isn’t just one score, it’s a whole squad, each built for different situations.

Credit score vs FICO score: What’s the difference?

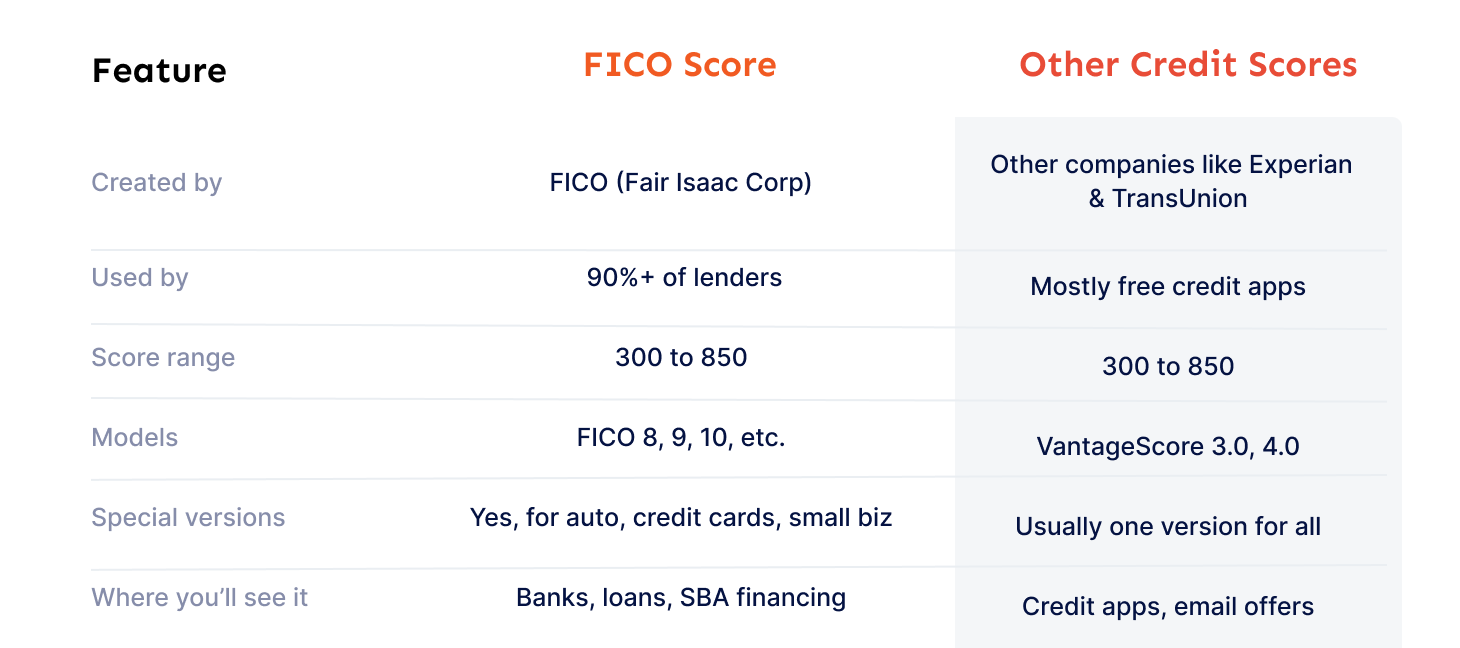

Here’s the easy way to get it: all FICO Scores are credit scores, but not all credit scores are FICO. Think of “credit score” as the general category, and FICO as the popular brand lenders actually use.

When lenders say “we’ll check your credit,” they usually mean your FICO Score. But a few apps often show you a VantageScore, which might look different.

Here’s a quick side-by-side:

Which score do lenders use for small business loans

Most lenders go straight to your FICO Score, especially for small business loans. If you’re applying through a bank or for an SBA loan, they’ll often use something called the FICO SBSS, which looks at your personal credit, business credit, and even revenue. A score of 140 is the minimum, but most lenders prefer 160-180.

Online lenders are a bit more flexible. Some use FICO 8 or 9, others might check VantageScore, and many also peek at business credit scores from Dun & Bradstreet, Experian, or Equifax.

Even if your business is up and running, your personal FICO Score still matters a lot, especially if your business credit is new or thin. Most lenders want to see a 650+ score before giving out funds. So yep, you still need to keep your personal credit strong.

Bottom line? Lenders love FICO, but they often check both personal and business credit before saying yes.

Why your personal FICO score still matters for business financing

Even if your business has a name, logo, and its own credit card, most lenders still want to know your credit story. That’s why your personal FICO Score plays a big role, especially if your business is new or doesn’t have much credit history yet.

Most small business loans, credit cards, and even SBA loans require a personal guarantee. That means if your business can’t pay, you’re on the hook. So, lenders check your personal FICO Score to see if they can trust you. Usually, they want to see a score above 650, and anything below 680 can lead to higher interest rates or limited options.

In short, your personal credit is still the backbone of your business’s ability to get money. Keep it clean, pay on time, and don’t max out those cards.

How to check both scores without hurting them

Let’s bust a myth real quick: checking your own credit score does NOT hurt it. You can stalk your score as much as you want, no judgment, no penalty. What hurts it is when a lender pulls your report during a loan or credit application. That’s called a hard inquiry, and it can take away a few points (usually 5–10).

So how do you check your scores the smart way?

Here’s a better way:

- For your FICO Score:

- Head to MyFICO.com (it’s the official source). It’s a paid service, but gives you real FICO scores, including versions lenders use.

- Some credit cards (like Discover, Amex, and Citi) show your FICO for free.

- For general credit scores (often VantageScore):

- Use free services like Credit Karma, Credit Sesame, or Mint.

- Just know that they usually show VantageScore, not FICO, so don’t freak out if it’s different from what your lender sees.

- For business credit scores:

- Tools like Nav give you both personal and business credit insights, with FICO SBSS access on paid plans.

- Dun & Bradstreet, Experian Business, and Equifax Business also let you check your biz profile (some free, some paid).

Still confused about credit score vs FICO score? Here’s what seals the deal

So, which one’s more important, your credit score or your FICO Score? Trick question. FICO is a credit score, but it’s the one that actually matters when you need a loan. While “credit score” is the umbrella term, most lenders look at your FICO score, especially when it comes to small business financing.

If you’re applying for a business loan, line of credit, or even a business credit card, odds are your personal FICO Score will take centre stage, especially if your business doesn’t have much credit history yet. And once you’ve built a business credit profile, that matters too, but FICO’s still often in the room, quietly judging.

Ready to boost your chances of getting funded?

Forwardly helps small businesses stay cash flow confident, because strong credit is just the start.

Get a product tour today.

Back to Blog

Back to Blog