If you’ve ever sent or received an invoice, you’ve probably come across the term “net 30.” It’s one of the most used payment terms in business, yet often misunderstood, and sometimes misused.

For many small businesses and freelancers, offering net 30 can feel like a gamble. On the one hand, it builds trust with clients and can make your business more appealing. On the other hand, it can stretch your cash flow thin, especially when clients delay payment beyond the 30-day mark.

So, what does net 30 mean, really? When does the clock start ticking? And is it the right fit for your business, and how to manage cash flow?

What does net 30 mean?

Net 30 means that the full payment for an invoice is due within 30 calendar days from the invoice date. It doesn’t mean “payment sometime soon” or “within a month of receiving the goods” – unless the terms specifically say so. It’s a contractual timeframe, and it matters.

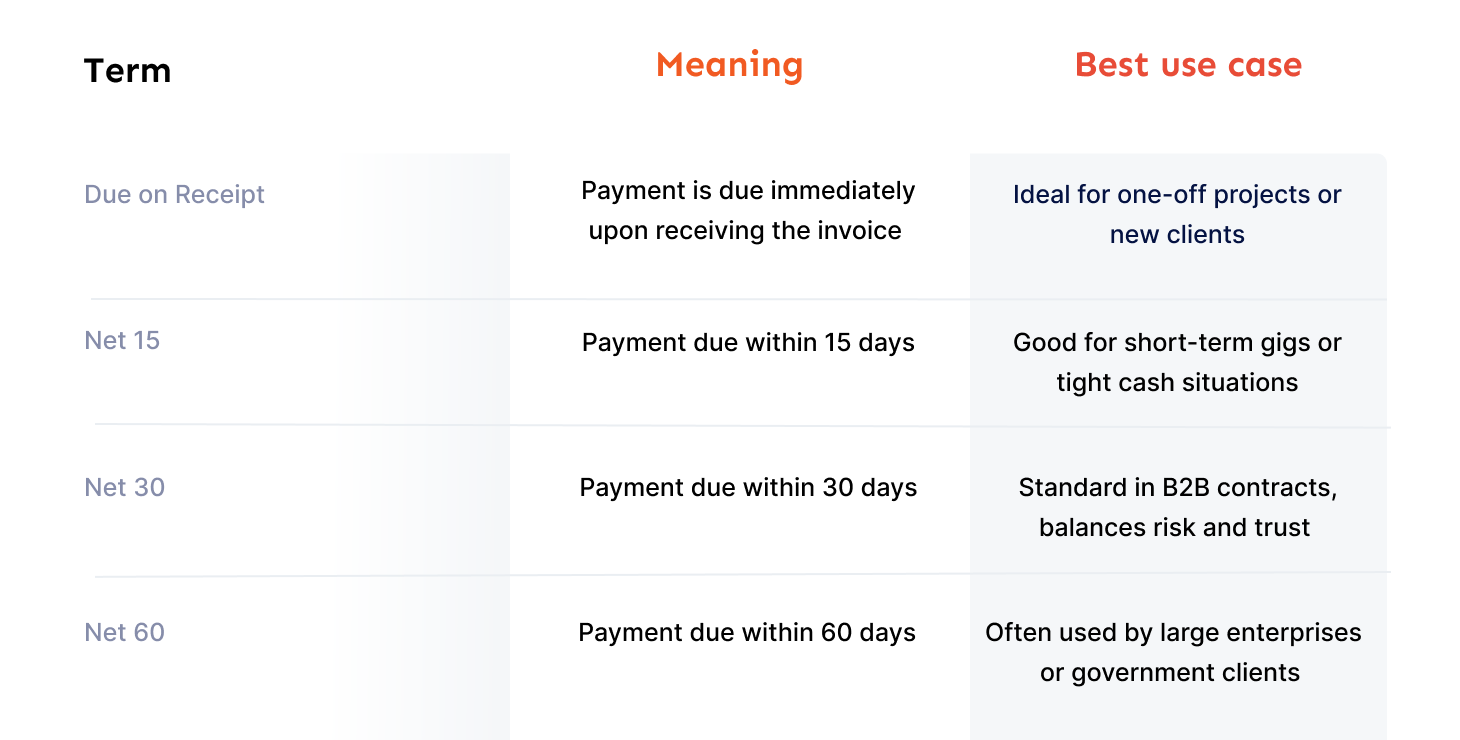

These kinds of terms, like net 15, net 30, net 60, are standard in B2B (business-to-business) transactions where work is delivered before payment is made. It’s common in industries like consulting, professional services, wholesale, creative agencies, SaaS, and construction.

In simple terms, you’re offering a short-term line of credit to your client.

If you’re a vendor or freelancer, you trust that the client will pay you 30 days after you send the invoice. If you’re the buyer, you agree to settle your balance by that deadline.

How net 30 works (and where confusion creeps in)

When does the 30-day period begin?

By default, net 30 starts from the invoice date, not the project delivery date or product shipment date. That said, some businesses use different terms like “net 30 EOM” (end of month) or negotiate custom terms based on delivery. It’s important to always check the invoice payment terms beforehand.

If you’re a service provider and your invoice isn’t sent promptly, you’re unintentionally extending the client’s grace period. For example, finishing a project on May 1st but invoicing on May 10th means you’re giving the client until June 9th to pay.

Pro tip: Always send the invoice as soon as work is delivered. Better yet, clarify in writing when “net 30” begins in your contracts or proposals.

Early payment discounts – “2/10 net 30”

To encourage faster payment, many businesses use a variation like “2/10 net 30”. This means:

The client gets a 2% discount if they pay within 10 days. Otherwise, full payment is due by day 30.

It’s a win-win if used well: you get cash sooner, and they save a bit. But be careful – if your margins are tight, that 2% discount can add up fast across multiple invoices.

Late payment penalties

If net 30 terms are offered, but payment consistently arrives at day 45 or 60, your cash flow suffers – and so does your ability to run your business smoothly.

To protect yourself, it’s common to include late fee clauses in contracts. For example:

“A 1.5% monthly interest will be applied to unpaid balances beyond the 30-day window.”

It’s not about being punitive – it’s about setting boundaries and reinforcing that you’re a business, not a bank.

Pros and cons of using net 30 terms

Every payment term comes with trade-offs, whether you’re on the receiving end or the paying end. Let’s look at both sides.

For sellers & vendors

Pros:

- Makes you more competitive. Offering flexible terms can help win deals, especially with established businesses.

- Builds trust. Extending credit shows confidence in the client relationship.

- Aligns with industry norms. In some sectors (like B2B SaaS or manufacturing), net 30 is expected.

Cons:

- Delays your cash inflow. If you’re paying staff, freelancers, or suppliers upfront, this lag can be risky.

- Chasing payments gets expensive. Following up takes time and may require tools or legal help if clients don’t comply.

- It can become net 45, net 60, or net never. Without enforcement or automation, you may fall behind fast.

For buyers

Pros:

- Improves working capital flexibility. You can receive goods/services now and pay later.

- Easier cash flow forecast. Especially helpful during slow seasons or unpredictable cycles.

- Encourages vendor trust. Good behavior on net 30 terms helps build long-term supplier relationships.

Cons:

- Easy to abuse. Without proper AP systems, payment deadlines can slip through the cracks.

- Incentive to delay. Some companies treat net 30 like a minimum rather than a maximum, which strains vendor relationships.

Net 30 vs. other payment terms

Here’s how net 30 compares with other common payment schedules:

If you’re unsure, start with net 15 or “Due on Receipt,” then offer net 30 once trust is established.

Should you go with net 30?

It depends – and there’s no one right answer. But asking yourself these questions can make the decision easier:

- Do I have enough cash flow to operate while waiting 30 days?

- Are my clients reliable and historically timely?

- Does my industry expect net 30, or can I set shorter terms?

And if you offer net 30, protect yourself:

- Put the terms in writing. No ambiguity.

- Include late fees and clearly state discounts, if any.

- Use automated reminders so clients don’t forget.

- Set up automated payment workflows with tools like Forwardly to eliminate the follow-up cycle.

Take control of your cash flow

Offering net 30 can be a smart move or a serious drag, depending on how prepared you are. It’s one thing to extend credit. It’s another thing to manage it well. If you’re juggling invoices, sending reminders, and wondering when that check will arrive, it’s time to take back control.

Forwardly simplifies the entire process. With Forwardly, you don’t just offer payment terms, but also you stay in control of them. Automate payments, get real-time payment updates, and give your clients faster, more convenient ways to pay.

No monthly fees. No complicated setup. Just faster payments and fewer headaches. Get started now!

Back to Blog

Back to Blog